12 Best CRM for Financial Advisors in 2025: A Deep Dive

Choosing the best CRM for financial advisors is a critical decision that directly impacts client relationship management, operational efficiency, and business growth. A generic CRM simply won't cut it; advisors need specialized tools designed for the intricate demands of wealth management, compliance, and personalized client communication. This guide cuts through the noise to provide a detailed, hands-on analysis of the top CRM platforms built specifically for the financial services industry.

We will move beyond marketing claims and dive into the practical realities of using each system. You'll find in-depth reviews of leading solutions like Redtail, Wealthbox, and Salesforce Financial Services Cloud, exploring how their features address the unique workflows of an advisory practice. We'll examine everything from household management and AUM tracking to compliance reporting and integration capabilities with essential fintech tools. As you consider CRM options, understanding the nuances of specialized support in financial services can provide valuable context for your client engagement strategy.

This resource is structured to help you make an informed choice efficiently. Each review includes:

- A concise summary of the platform's core strengths.

- Practical use cases demonstrating how the CRM solves real-world advisor challenges.

- An honest look at potential limitations or implementation hurdles.

- Detailed screenshots to give you a feel for the user interface.

Our goal is to equip you with the insights needed to select a CRM that not only organizes your contacts but becomes the central hub of your advisory business, empowering you to deliver exceptional client service and scale effectively. Let's explore the top options available today.

1. Redtail CRM

Redtail CRM has become a near-ubiquitous name in the wealth management industry, establishing itself as a go-to platform specifically engineered for the daily realities of financial advisors. It stands out by offering a comprehensive, industry-specific feature set right out of the box, eliminating the need for extensive customization that generalist CRMs often require. Advisors can manage client relationships, track opportunities, and automate complex, multi-step service workflows from a single, centralized hub.

Its deep integration network with major custodians, financial planning software, and portfolio management tools like Orion is a key differentiator. This connectivity creates a seamless data flow, significantly reducing manual data entry and potential errors. For advisors seeking an all-in-one solution, Redtail's optional add-ons like "Speak" for compliant texting and "Imaging" for document storage provide a cohesive, FINRA-friendly ecosystem. While Redtail is a powerful tool, some users find its user interface less modern compared to newer market entrants, a point to consider during evaluation. If you're exploring how CRM functionalities benefit various business types, you can see how Redtail's features compare in this overview of CRM software for small businesses.

Key Considerations

- Best For: Independent advisors and RIAs who need a proven, wealth-focused CRM with extensive integrations and robust compliance features.

- Pricing: Redtail offers a straightforward pricing model at $99 per user, per month, with a 30-day free trial to test the platform. Add-on services like Redtail Speak and Imaging are priced separately.

- Implementation Tip: Take full advantage of the free trial and migration assistance to connect your key technology stack (e.g., custodian, planning software) and test essential workflows before committing.

| Feature Highlights | Details |

|---|---|

| Advisor Workflows | Pre-built and customizable templates for client onboarding, reviews, and more. |

| Integrations | Extensive library connecting to custodians, Orion, MoneyGuidePro, and others. |

| Compliance Tools | Optional compliant texting (Speak) and cloud document storage (Imaging). |

| Accessibility | 30-day free trial and dedicated migration and onboarding support. |

2. Wealthbox CRM

Wealthbox CRM enters the market as a modern, user-friendly alternative, challenging legacy systems with its intuitive design and collaborative focus. It’s built for financial advisors who prioritize simplicity and quick adoption, offering a clean interface that resembles a social media feed, making it immediately familiar to most users. This design philosophy reduces the typical learning curve associated with CRMs, allowing advisory teams to get up and running with minimal training. The platform excels at managing daily activities through collaborative tasking, automated workflows, and visual opportunity pipelines.

A key strength of Wealthbox lies in its powerful mobile apps and deep integrations with essential advisor technology like Schwab, Fidelity, and eMoney. This connectivity ensures that client data remains synchronized across the firm's tech stack, streamlining operations and providing a holistic view of client relationships from anywhere. While it may offer fewer deep, enterprise-level customizations compared to platforms built on Salesforce, its out-of-the-box functionality is more than sufficient for most independent RIAs and broker-dealer teams. Its straightforward approach makes it one of the best CRM for financial advisors seeking efficiency without complexity.

Key Considerations

- Best For: Advisory firms prioritizing ease-of-use, team collaboration, and a modern interface with strong mobile capabilities.

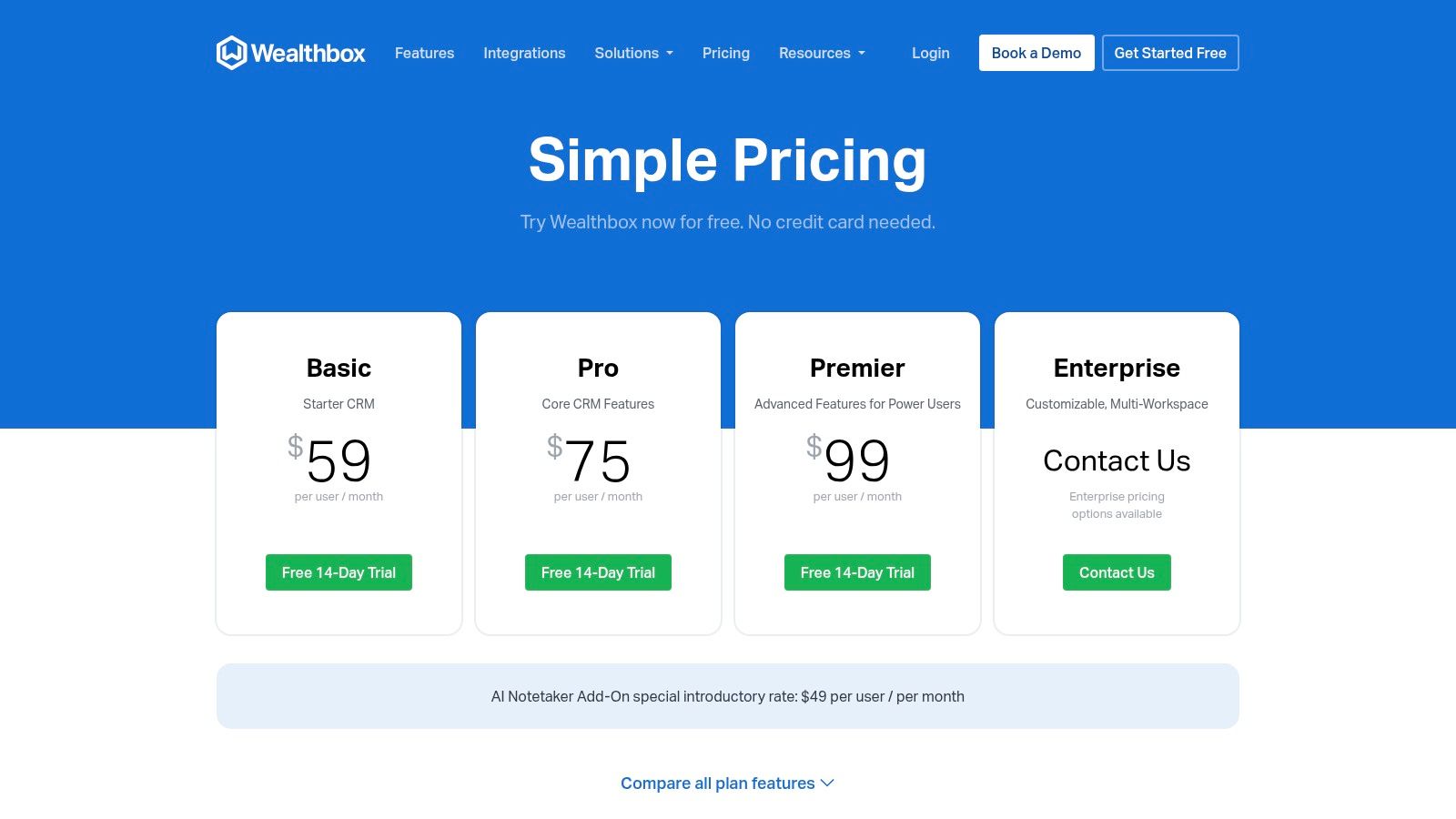

- Pricing: Wealthbox offers several tiers, starting with the Basic plan at $49 per user, per month. The more popular Pro plan is $65 per user, per month, and a 14-day free trial is available.

- Implementation Tip: Use the 14-day trial to have your entire team test the collaborative features, like shared tasks and the activity stream, to gauge how it fits your firm's communication style.

| Feature Highlights | Details |

|---|---|

| Intuitive UI | A social media-style activity stream and clean design promote fast user adoption. |

| Mobile Access | Fully-featured native iOS and Android apps for managing the business on the go. |

| Advisor Integrations | Connects seamlessly with major custodians, financial planning, and portfolio tools. |

| Native Workflows | Built-in tools for creating multi-step processes for client onboarding and service. |

3. Salesforce Financial Services Cloud (FSC)

For enterprise-level firms and advisory teams demanding unparalleled customization and scalability, Salesforce Financial Services Cloud (FSC) is a dominant force. Built upon the world's leading CRM platform, FSC provides a specialized data model engineered for wealth management. It inherently understands concepts like client households, financial goals, and complex relationships, which allows for a much deeper and more holistic view of a client’s financial life compared to a generic CRM. This structure serves as the foundation for powerful segmentation, analytics, and automated advisor workflows.

The platform's key differentiator is its extreme extensibility, supported by the massive AppExchange ecosystem. This allows firms to bolt on specialized applications for everything from compliance to marketing automation, creating a truly bespoke technology stack. While its power is immense, FSC comes with significant implementation complexity and a higher total cost of ownership, often requiring dedicated IT resources or consulting partners to configure and maintain. It's the best CRM for financial advisors in large organizations that view their technology as a core strategic advantage and are prepared to invest accordingly.

Key Considerations

- Best For: Large RIAs, broker-dealers, and enterprise firms that require deep customization, advanced analytics, and the ability to scale operations across multiple offices or divisions.

- Pricing: FSC pricing is tiered, starting at $225 per user, per month for the Professional Edition. Higher tiers add features like AI (Einstein) and enhanced analytics, with custom pricing for enterprise needs.

- Implementation Tip: Engage a certified Salesforce implementation partner specializing in wealth management. They can help map your firm's unique processes to the platform's capabilities and ensure a successful rollout.

| Feature Highlights | Details |

|---|---|

| Industry Data Model | Pre-built objects for households, financial accounts, goals, and relationships. |

| Extensibility | Access to the Salesforce AppExchange for thousands of integrated apps. |

| AI & Analytics | Einstein AI offers predictive insights and next-best-action recommendations (in higher editions). |

| Scalability | Enterprise-grade infrastructure designed to support complex, multi-location firms. |

Visit Salesforce Financial Services Cloud

4. Practifi

Practifi is a business management platform designed specifically for the wealth management industry, built on the robust foundation of Salesforce. It moves beyond a traditional CRM by providing a comprehensive, firm-wide operating system with prescriptive processes for everything from client onboarding to annual reviews. This focus on structured, repeatable workflows makes it an excellent choice for growing advisory firms aiming to standardize operations and ensure consistent client service across multiple teams.

The platform stands out by embedding industry best practices directly into its design, offering guided implementation and dedicated support to help firms get up and running effectively. Its powerful analytics dashboard gives leadership a clear view of firm-wide performance, client segmentation, and revenue trends. While leveraging the extensive Salesforce AppExchange for integrations, Practifi’s core strength lies in its pre-configured, wealth-specific functionality. For those interested in how these pre-built processes operate, this guide explains what is an automated workflow in a business context. The trade-off for this power is a higher implementation lift and a price point that reflects its enterprise-grade capabilities.

Key Considerations

- Best For: Mid-to-large sized RIAs and enterprises seeking a scalable, all-in-one business management platform with built-in compliance and operational workflows.

- Pricing: Pricing is customized and available upon request through a guided demo. It typically involves an annual commitment and implementation fees.

- Implementation Tip: Engage with Practifi's implementation team to clearly define your firm’s key processes and data migration needs to ensure the platform is configured to your exact specifications from day one.

| Feature Highlights | Details |

|---|---|

| Advisor Workflows | Prescriptive, built-in processes for onboarding, reviews, RMDs, and more. |

| Integrations | Leverages the Salesforce AppExchange and has an open API for custom connections. |

| Firm Analytics | Robust dashboards for tracking AUM, revenue, client segmentation, and team productivity. |

| Implementation | Guided demos and dedicated implementation support to tailor the platform to your firm. |

5. AdvisorEngine CRM (formerly Junxure)

AdvisorEngine CRM, built on the legacy of the well-respected Junxure platform, delivers a robust and feature-rich experience tailored specifically for wealth management firms. It excels at combining deep client relationship management with powerful, firm-wide operational tools. The platform is designed to be a central command center, offering visual dashboards, sophisticated workflow automation, and comprehensive prospecting and practice management features that help advisors scale their operations efficiently.

A key advantage of AdvisorEngine is its commitment to creating a cohesive, all-in-one ecosystem. The inclusion of unlimited document storage and priority support with migration and training resources makes it an attractive option for firms looking for a high-touch implementation process. While its pricing is transparent, the requirement for annual billing and a three-user minimum positions it more for established teams rather than solo practitioners. For advisors seeking a comprehensive system, AdvisorEngine stands out as one of the best CRM for financial advisors that can manage both client-facing and back-office tasks with equal proficiency.

Key Considerations

- Best For: Established advisory teams and RIAs seeking a powerful, all-in-one platform with strong workflow automation and dedicated support.

- Pricing: Pricing is published and starts per user, per month, but requires annual billing and a minimum of three users.

- Implementation Tip: Leverage the included priority support and training resources to map out your firm's core processes within the platform’s workflow engine from day one to maximize its efficiency.

| Feature Highlights | Details |

|---|---|

| Workflow Automation | Robust, customizable engine to streamline multi-step processes like onboarding. |

| Practice Management | Integrated tools for prospecting, business metrics tracking, and reporting. |

| Unlimited Storage | Includes unlimited cloud document storage for all client-related files. |

| Support & Training | Offers priority support, migration assistance, and training resources. |

6. SS&C Salentica

SS&C Salentica caters to enterprise-level advisory firms and multi-office RIAs by building its solutions on top of industry-leading platforms: Salesforce and Microsoft Dynamics 365. This approach provides a powerful, familiar foundation while layering on pre-built wealth management data models, workflows, and relationship hierarchies specific to financial services. It is designed for firms that require deep customization, enterprise-grade governance, and the ability to manage complex organizational structures without starting from scratch.

A core differentiator is the Salentica Data Broker, which facilitates robust, bi-directional integrations with major custodians, financial planning software, and portfolio reporting systems. This ensures data consistency across a firm's entire tech stack. While it offers immense power and scalability, Salentica is not a plug-and-play solution. Implementations are typically more involved and costly compared to SMB-focused CRMs, reflecting its target market of larger, more complex organizations. This platform is a strong contender for firms looking for one of the best CRM for financial advisors with an enterprise focus.

Key Considerations

- Best For: Large RIAs, multi-family offices, and broker-dealers needing an enterprise-grade CRM built on a Salesforce or Microsoft Dynamics foundation.

- Pricing: Pricing is not publicly listed and is provided on a custom-quote basis, reflecting the tailored nature of its implementation and licensing.

- Implementation Tip: Engage a dedicated project manager and expect a comprehensive discovery process. Clearly map your firm's unique data requirements and workflows before implementation begins to leverage the platform's full potential.

| Feature Highlights | Details |

|---|---|

| Enterprise Foundation | Available as Salentica Elements (on Salesforce) or Salentica Engage (on Microsoft Dynamics). |

| Salentica Data Broker | A specialized middleware service for deep integrations with custodians and fintech tools. |

| Complex Modeling | Advanced capabilities for modeling intricate household, entity, and client relationships. |

| Wealth-Specific Workflows | Comes with pre-built workflow libraries for common advisory processes. |

7. Envestnet | Tamarac CRM

Envestnet | Tamarac CRM leverages the power of Microsoft Dynamics 365, delivering an enterprise-grade platform specifically configured for wealth management firms. Its core strength lies in its native integration within the broader Tamarac ecosystem, which includes performance reporting, trading, and rebalancing tools. This creates a unified environment where advisors can manage the entire client lifecycle, from prospecting and onboarding to portfolio management and ongoing service, all from a single interface. The CRM acts as the central hub, providing a complete, 360-degree view of client relationships.

The platform’s deep connection with Tamarac Reporting/Trading and MoneyGuide planning software is its primary differentiator. This tight integration ensures that critical client financial data flows seamlessly between applications, eliminating data silos and manual reconciliation. Advisors benefit from powerful business intelligence dashboards and automated workflows that are directly tied to portfolio and planning information. However, Tamarac CRM is typically sold as part of a comprehensive suite, making it a less viable standalone option for firms not already invested in the Envestnet ecosystem. This positioning makes it one of the best CRM for financial advisors who prioritize an all-in-one, deeply integrated technology stack.

Key Considerations

- Best For: RIAs already using or planning to adopt the full Tamarac suite for reporting, trading, and financial planning who need a deeply integrated CRM.

- Pricing: Pricing is not publicly listed and is typically bundled as part of a broader Envestnet | Tamarac platform package. Firms must contact sales for a custom quote.

- Implementation Tip: Ensure your team is prepared for a more enterprise-level implementation. Leverage the native Office 365 and Outlook tie-ins from day one to maximize user adoption and data synchronization.

| Feature Highlights | Details |

|---|---|

| Unified Platform | Natively connects CRM with Tamarac Reporting, Trading, and MoneyGuide. |

| Microsoft Dynamics 365 Core | Built on a robust, scalable foundation with deep Outlook and Office 365 integration. |

| Business Intelligence | Advanced dashboards and reporting capabilities that pull data across the entire platform. |

| Automated Workflows | Create and manage complex, multi-step processes for client service and operations. |

8. SmartOffice (Ebix)

SmartOffice by Ebix is a veteran in the CRM space, particularly well-regarded within insurance and broker-dealer channels. Its strength lies in a mature, comprehensive feature set that extends beyond standard client management to include specialized tools for commissions and insurance policy tracking. This makes it a compelling option for firms where insurance products are a core part of the business, offering a unified platform for both wealth management and insurance-related activities. The system is designed for front-office process management, helping advisors streamline everything from lead capture to ongoing client service.

While its deep functionality is a significant advantage for complex organizations, the platform's long history means its interface may not feel as modern as some newer competitors. Its enterprise deployment options cater to larger firms needing robust control and scalability. When evaluating SmartOffice, it's crucial to clarify all terms, as some users have reported potential data-export fees, highlighting the importance of a thorough contract review. For firms deeply embedded in both the advisory and insurance worlds, SmartOffice remains one of the best CRM for financial advisors choices due to its specialized, dual-purpose capabilities.

Key Considerations

- Best For: Broker-dealers and financial advisory firms with a strong insurance component who need integrated commission tracking and policy management.

- Pricing: Pricing is not publicly available and requires a direct quote. Prospective users should inquire about setup, licensing, and any potential data-related fees.

- Implementation Tip: During the sales process, request a detailed demonstration focused specifically on your firm's insurance and commission workflows to ensure it meets your unique needs.

| Feature Highlights | Details |

|---|---|

| Insurance & Commissions | Specialized modules for tracking insurance policies and calculating commissions. |

| Process Management | Tools to manage front-office processes for consistent client service. |

| Pipeline Management | Traditional contact and opportunity management features to track leads and sales. |

| Enterprise Options | Scalable deployment models suitable for larger, more complex organizations. |

9. XLR8 (Concenter Services)

XLR8 offers a unique proposition for advisory firms that want the power and scalability of Salesforce without the daunting task of building a custom instance from the ground up. Provided by Concenter Services, XLR8 is an overlay that preconfigures the Salesforce platform with essential wealth management features, including a household and client data model, advisor-specific workflows, and compliance tools. This approach significantly accelerates implementation, allowing firms to leverage a world-class CRM infrastructure much faster than a typical bespoke Salesforce project.

A key advantage of the XLR8 model is its bundled pricing, which includes the Salesforce Financial Services Cloud license along with consulting, migration, and training services. This transparency simplifies budgeting and removes the guesswork often associated with Salesforce implementation costs. While it speeds up the process, firms should recognize that an implementation project is still necessary to tailor the platform to their specific needs, and more advanced customizations can incur additional costs. XLR8 is one of the best CRM for financial advisors looking for a middle ground between a rigid, off-the-shelf product and a fully custom build.

Key Considerations

- Best For: Growing RIAs and wealth management firms that desire the power of Salesforce but need a structured, expedited implementation process with predictable costs.

- Pricing: Bundled pricing starts at $185 per user, per month, which includes the Salesforce license, XLR8 features, and support. A one-time implementation fee is also required.

- Implementation Tip: Clearly define your firm's most critical workflows and data needs upfront to ensure the initial implementation project covers your highest priorities, minimizing scope creep and additional future costs.

| Feature Highlights | Details |

|---|---|

| Salesforce Foundation | Built on the Salesforce Financial Services Cloud, offering enterprise-grade security and scalability. |

| Advisor-Centric Model | Pre-built household/client data models, workflows, and dashboards designed for wealth management. |

| Bundled Services | Pricing includes the Salesforce license, plus essential data migration, training, and customization services. |

| Integrations | Connects with key advisor tools like FinFolio for reporting and Flourish for cash management. |

10. HubSpot Sales Hub

HubSpot Sales Hub is a powerful generalist CRM that has gained traction among modern advisory firms focused on inbound marketing and scalable sales processes. Unlike industry-specific platforms, HubSpot excels at managing the entire client acquisition lifecycle, from lead capture with its marketing tools to prospect nurturing with automated sales sequences. Its user-friendly interface is a major draw, facilitating quick adoption across a team without a steep learning curve.

The platform's strength lies in its seamless integration with the broader HubSpot ecosystem, including Marketing Hub and Service Hub. This creates a unified view of every client interaction, from website visits to service tickets. While it lacks native, deep wealth management integrations and compliance features out-of-the-box, its extensive app marketplace can bridge some gaps. HubSpot is often the best CRM for financial advisors who prioritize lead generation and a polished, all-in-one go-to-market system over deep, pre-built financial planning integrations.

Key Considerations

- Best For: Growth-oriented advisory firms that prioritize marketing automation, lead generation, and an all-in-one sales and service platform.

- Pricing: HubSpot offers a free tier with basic tools. Paid plans scale from Starter (starting around $45/month) to Professional and Enterprise tiers, which can become costly. Onboarding fees often apply for higher-level plans.

- Implementation Tip: Carefully map out your compliance requirements. You will likely need to integrate third-party tools or establish strict internal governance to meet industry regulations for communication and data archiving.

| Feature Highlights | Details |

|---|---|

| Unified Platform | Tightly integrates with HubSpot's Marketing, Service, and CMS hubs for a single client view. |

| Sales Automation | Automate follow-ups, schedule meetings, and create email sequences to nurture leads. |

| App Marketplace | A large ecosystem of third-party apps to add functionality, though wealth-specific tools are limited. |

| Reporting & Analytics | Robust reporting capabilities, especially in Professional and Enterprise tiers, for forecasting and pipeline analysis. |

11. Zoho CRM (Financial Services)

Zoho CRM is a powerful and highly adaptable platform that extends its capabilities to the wealth management sector through its financial services vertical. While not built exclusively for advisors like some competitors, its strength lies in extreme customizability and affordability, making it an excellent choice for firms willing to tailor a system to their precise needs. Advisors can leverage its robust workflow automation, known as Blueprints, to design and enforce specific processes for client onboarding, compliance checks, and regular portfolio reviews.

A key differentiator for Zoho is its expansive ecosystem of business apps and a vast network of integration partners. The "Zoho One" bundle offers an all-in-one operating system for businesses, combining CRM with marketing, analytics, and support tools at an unbeatable price point. While the initial setup requires more effort to create wealth-specific workflows, the platform's flexibility is nearly limitless. For firms weighing it against other market leaders, understanding the differences is key, as highlighted in this in-depth comparison of Zoho and Salesforce.

Key Considerations

- Best For: Cost-conscious advisors, RIAs, and larger firms that prioritize customizability and are willing to invest time or partner resources to configure advisor-specific workflows.

- Pricing: Zoho offers multiple tiers, including a free-forever plan for up to three users. Paid plans are highly competitive, starting around $14 per user/month, with the comprehensive Zoho One bundle offering exceptional value.

- Implementation Tip: Engage with a Zoho implementation partner specializing in financial services to accelerate the setup of compliance workflows, custom dashboards, and integrations with your core tech stack.

| Feature Highlights | Details |

|---|---|

| Workflow Automation | "Blueprints" allow for the creation of rigid, guided processes for key tasks. |

| Customization | The "Canvas" UI builder allows for a complete redesign of the user interface. |

| Ecosystem | Can be bundled with 40+ other Zoho apps (Zoho One) for a unified business suite. |

| Accessibility | Offers a free plan and multiple paid tiers to fit different budget and feature needs. |

Visit Zoho CRM (Financial Services)

12. G2: Financial Services CRM Category

G2 serves as a critical resource for due diligence rather than a CRM platform itself. It's a leading software marketplace where financial advisors can leverage crowdsourced user reviews, detailed feature comparisons, and dynamic market grids to validate their CRM choices. Instead of relying solely on vendor marketing, G2 allows you to see how real-world users rate platforms on usability, support, and specific functionalities, which is invaluable when searching for the best CRM for financial advisors.

The platform's strength lies in its ability to help you discover and shortlist potential solutions. You can filter CRMs based on company size, user satisfaction scores, and specific features, then compare your top choices side-by-side. This direct comparison, backed by verified user feedback, provides a layer of unbiased insight that can highlight potential red flags or confirm a platform’s suitability for your firm’s unique needs. While the "Financial Services CRM" category is broad and includes tools for banking and insurance, careful filtering makes it an excellent validation step in your selection process.

Key Considerations

- Best For: Advisors in the research and selection phase who want to compare potential CRMs using peer reviews and data-driven market intelligence.

- Pricing: Free to access and use for research and comparison purposes.

- Implementation Tip: Use G2’s comparison grids and reviews to create your initial shortlist. Pay close attention to reviews from users with a similar firm size and business model to your own for the most relevant insights.

| Feature Highlights | Details |

|---|---|

| Crowdsourced Reviews | Access hundreds of verified user reviews with detailed feedback on pros and cons. |

| Comparison Grids | Visually compare platforms based on user satisfaction and market presence. |

| Feature Filtering | Drill down into specific categories and features to find tools that meet your needs. |

| Vendor Validation | Triangulate vendor claims with authentic user experiences before committing. |

Visit G2: Financial Services CRM category

Top 12 Financial Advisor CRMs — Feature Comparison

| Product | Core features | UX / Quality (★) | Price & Value (💰) | Target audience (👥) | Unique / USP (✨ / 🏆) |

|---|---|---|---|---|---|

| Redtail CRM | Advisor workflows, compliant texting (Speak), Imaging, custodian integrations | ★★★★ | 💰 Transparent tiers + 30‑day trial | 👥 Financial advisors & RIAs | ✨ Strong compliance tooling & Orion ecosystem integration 🏆 |

| Wealthbox CRM | Intuitive UI, pipelines, mobile apps, custodian/planning integrations | ★★★★ | 💰 Clear tiers + 14‑day trial | 👥 Small–mid advisor teams | ✨ Fast adoption with minimal training |

| Salesforce Financial Services Cloud (FSC) | Industry data model, KYC/households, goals, AI options, AppExchange | ★★★★★ | 💰💰💰 High total cost; enterprise scale | 👥 Large firms, multi‑office enterprises | ✨ Extreme extensibility & AppExchange ecosystem 🏆 |

| Practifi | Prescriptive advisor workflows on Salesforce, analytics, guided implementation | ★★★★ | 💰 Sales‑only pricing; annual commitments | 👥 Scaling wealth firms needing guided rollout | ✨ Purpose‑built workflows + implementation support |

| AdvisorEngine CRM | Visual dashboards, workflow engine, prospecting, unlimited docs | ★★★★ | 💰 Transparent per‑user pricing (annual min) | 👥 Advisors wanting feature‑rich, advisor‑focused CRM | ✨ Priority support & clear pricing |

| SS&C Salentica | Salesforce/Microsoft foundations, data broker, household models | ★★★★ | 💰 Enterprise pricing (not public) | 👥 Larger/multi‑office firms | ✨ Deep integrations & enterprise governance |

| Envestnet | Tamarac CRM | Dynamics‑based CRM with Tamarac reporting/trading & MoneyGuide ties | ★★★★ | 💰 Often bundled; pricing not public | 👥 RIAs using Tamarac / MoneyGuide |

| SmartOffice (Ebix) | Contact/opportunity mgmt, pipelines, commissions, front‑office processes | ★★★ | 💰 Pricing not public; check export fees | 👥 Insurance firms & broker‑dealers | ✨ Mature insurance/commission feature set |

| XLR8 (Concenter) | Preconfigured Salesforce bundle, integrations, migration & training | ★★★★ | 💰 Published bundle price including Salesforce seat | 👥 Firms wanting Salesforce without custom build | ✨ Speeds time‑to‑value with bundled services |

| HubSpot Sales Hub | Sales automation, sequences, calling, marketing/service integrations | ★★★★ | 💰 Free → Enterprise (scales) | 👥 Teams prioritizing marketing & go‑to‑market | ✨ Unified marketing/sales/service ecosystem |

| Zoho CRM (Financial Services) | Blueprints, Canvas UI, Zia AI, 600+ integrations, CRM Plus bundles | ★★★ | 💰 Very competitive; free tier available | 👥 Cost‑sensitive firms & DIY implementers | ✨ Highly customizable at low cost |

| G2: Financial Services CRM | Filterable rankings, reviews, side‑by‑side comparisons, vendor links | ★★★★ | 💰 Free to use | 👥 Buyers shortlisting CRM vendors | ✨ Crowdsourced reviews & category grids for validation 🏆 |

Final Thoughts

Navigating the crowded market for the best CRM for financial advisors can feel overwhelming. We've journeyed through a comprehensive list, from industry-specific powerhouses like Redtail and Wealthbox to the endlessly customizable Salesforce Financial Services Cloud and the enterprise-grade Practifi. Each platform offers a unique philosophy on how to manage client relationships, streamline workflows, and ultimately, grow your practice. The key takeaway is that there is no single "best" solution; there is only the best fit for your specific firm, your unique processes, and your future growth ambitions.

The right CRM is more than just a digital rolodex. It's the central nervous system of your advisory business, the engine that powers client communication, compliance tracking, and business development. Making the right choice is a strategic decision that will impact your firm's efficiency and scalability for years to come.

Recapping Your Options: The Big Picture

Let’s distill our findings into core categories to help you align your needs with the right platform.

-

For the Independent Advisor or Small RIA: Solutions like Wealthbox and Redtail CRM often hit the sweet spot. They offer an intuitive user experience, robust core features, and a wealth of integrations at a price point that doesn't break the bank. Their focus on simplicity and ease of use means you can get up and running quickly, focusing on clients rather than complex configurations.

-

For the Growth-Focused, Mid-Sized to Large Firm: If your firm is scaling rapidly and requires deep customization, advanced workflow automation, and sophisticated reporting, platforms like Salesforce FSC and Practifi are your top contenders. They are built to handle complexity, manage multiple teams, and provide a 360-degree view of the entire client lifecycle. Be prepared, however, for a more significant investment in both time and financial resources for implementation.

-

For the TAMP-Integrated or All-in-One Seeker: Advisors who prioritize a unified technology stack will find immense value in platforms like AdvisorEngine CRM and Envestnet | Tamarac CRM. These systems are designed to integrate seamlessly with broader portfolio management and financial planning tools, creating a cohesive ecosystem that reduces redundant data entry and streamlines client servicing.

Your Action Plan: How to Choose Your CRM

Feeling informed is one thing; making a decision is another. Here are the actionable next steps you should take to select and implement the best CRM for your financial advisory practice.

-

Define Your "Must-Haves" vs. "Nice-to-Haves": Before you watch a single demo, document your non-negotiable requirements. Do you absolutely need household-level reporting? Is a seamless integration with your custodian a top priority? Is a mobile app critical for your on-the-go advisors? Separate these from features that would be beneficial but aren't deal-breakers.

-

Map Your Core Workflows: How does a new lead become a prospect, and then a client? What are the key stages of your client onboarding process? Document these workflows step-by-step. This map will be your guide when evaluating how each CRM can automate and improve your existing processes.

-

Engage Your Team: The best CRM will fail if your team doesn't adopt it. Involve key stakeholders in the evaluation process. Ask them about their daily pain points and what features would make their jobs easier. Buy-in from the start is crucial for a successful implementation.

-

Commit to the Trial Period: Don't just click around during a free trial. Treat it as a real-world test. Import a small, sanitized subset of your client data. Try to execute one of your core workflows from start to finish. This hands-on experience will reveal more than any sales demo ever could.

Ultimately, choosing the best CRM for financial advisors is an investment in your firm's future. It's about finding a partner that not only solves today's challenges but also provides the foundation to support your growth for the next decade. Take your time, do your due diligence, and select the platform that empowers you to deliver exceptional value to your clients.

As you enhance your client management with a new CRM, ensuring a steady stream of high-quality leads is the next critical step for growth. LeadSavvy Pro bridges the gap by instantly syncing your leads from platforms like Facebook Lead Ads directly into your CRM, eliminating manual data entry and enabling immediate follow-up. Discover how to supercharge your lead-to-client pipeline by visiting LeadSavvy Pro today.