Mapping the Global Distribution of Lead

The global story of lead is a messy one. It’s not just about where we dig it out of the ground. It’s a complex journey that spans geology, global economics, and ultimately, a tragic human cost.

To really get a handle on the distribution of lead, you have to look at it from three different angles. These pieces are deeply connected, but they each tell a distinct part of the story.

The Three Faces of Lead Distribution

Think of lead's journey from a raw mineral to a major public health hazard. It’s a path that reveals a lot about our global systems.

You can't just look at one part of the puzzle. For instance, a country with enormous natural reserves isn't always the biggest refiner. And sometimes, the biggest consumers of lead products aren't the ones who suffer the most from its toxic effects. These disconnects are where the real story lies.

The Geological Lottery

First off, there's the simple luck of the draw—geology. Nature didn't sprinkle lead evenly across the globe.

A handful of countries, like Australia and China, hit the geological jackpot. They hold a massive chunk of the world's accessible lead reserves. This gives them a huge strategic advantage and makes them the starting point for the entire global supply chain. Everything else flows from this simple fact of where the lead is buried.

Economic and Trade Realities

Next, the lead hits the open market. This is where things get interesting.

Here, different nations take the lead (no pun intended) in mining, refining, and actually using the stuff. A country might have almost no natural lead reserves but become a major player because it’s a refining hub or has massive industrial needs. It’s all driven by economics, creating a complex web of trade and dependency.

I've seen this firsthand—the flow of lead is dictated by industrial demand, not just where it comes from. The explosion in battery manufacturing, for example, completely reshaped trade patterns and created new economic powerhouses in the lead industry almost overnight.

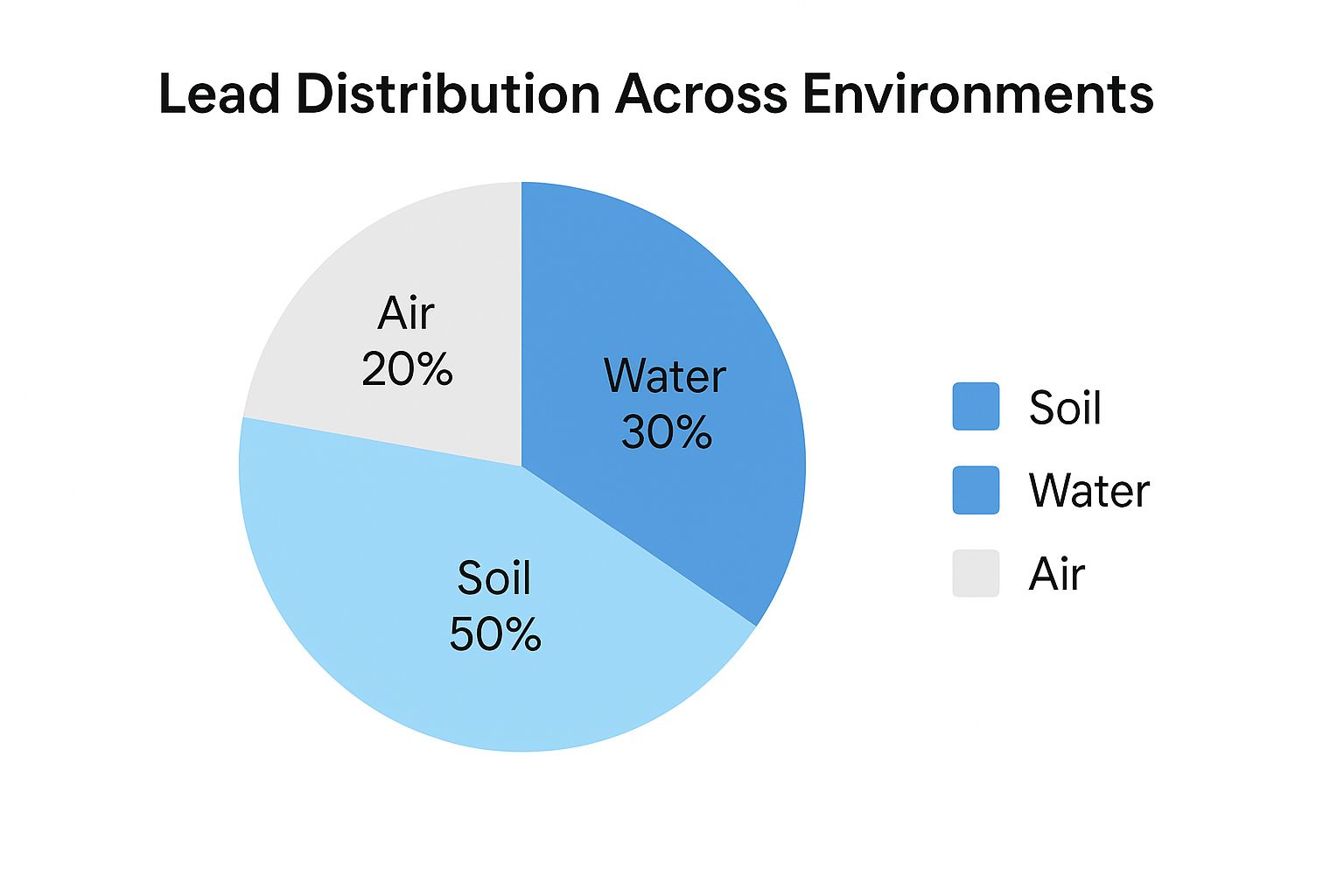

The infographic below really drives home what happens when lead gets out into the environment from all this industrial activity.

As you can see, soil is the primary sink for environmental lead contamination, soaking up a staggering 50% of it. That has serious, long-term consequences for everything from farming to public health.

The Public Health Crisis

Finally, we get to the most critical part: the human cost.

The burden of lead exposure isn't shared equally. It falls heaviest on developing nations, often thousands of miles from where the lead is actually being used in high-tech applications. Why the disconnect? It usually comes down to a few key factors:

- Unregulated Industrialization: Industries pop up fast without the right environmental safeguards in place.

- Informal Recycling: Dangerous practices, like backyard battery recycling, are common and release huge amounts of lead.

- Weak Health Enforcement: A lack of resources to monitor lead levels and protect the public.

This creates a terrible paradox. The communities suffering the worst health problems are often the ones who benefit the least from lead-based technologies. By breaking down these three dimensions—geology, trade, and health—we get a much clearer picture of lead's complicated journey around the world.

Lead Distribution at a Glance

This table provides a high-level summary of how lead's journey unfolds globally, highlighting the key players at each stage.

| Distribution Area | Key Countries/Regions | Primary Driver |

|---|---|---|

| Geological Reserves | Australia, China, Peru | Natural geological deposits |

| Global Trade & Refining | China, India, South Korea | Industrial demand, manufacturing capacity |

| Health Impact Burden | Low/Middle-Income Nations | Lack of regulation, informal recycling |

Ultimately, this shows a clear pattern: wealth from lead is concentrated in a few nations with geological resources or industrial power, while the health risks are exported to regions with the least capacity to manage them.

Where the World's Lead Reserves Are Found

The global journey of lead starts deep inside the earth, and where it's found is really a matter of geological luck. It's not spread out evenly. Instead, lead deposits are packed into very specific regions, which naturally creates a hierarchy of who holds all the cards in the supply chain.

If you want to understand the lead market—from mining all the way to manufacturing—you first have to know where these reserves are. For the countries that have them, these deposits aren't just geological quirks; they're strategic national assets. They give these nations a ton of sway over the global supply chain, letting them influence prices and lock down their own industrial futures.

The Power Players in Lead Reserves

When you look at the global map of economically viable lead reserves, you'll see a small club of countries holding the lion's share. This concentration gives them some serious leverage. And these aren't just fuzzy estimates; they represent real economic power that shapes international trade and industry for decades.

So, who are the big players?

- Australia leads the pack, sitting on about 4.5 million tonnes of lead reserves.

- China is right behind with around 4 million tonnes, cementing its role as not just a top user but also a major resource holder.

- Russia holds an estimated 2.8 million tonnes, making it another critical supplier on the world stage.

- The United States and Peru are also significant, each holding between 1.5 to 2 million tonnes.

If you're interested in the nitty-gritty, you can find more details on how these global lead reserve statistics stack up.

The chart below paints a clear picture of this distribution.

You can see right away how much Australia and China dominate. Together, they control a massive slice of the world's known lead deposits, which gives them a fundamental role in shaping the entire global supply landscape.

Why Are Reserves So Concentrated?

So why isn't lead found everywhere? It all comes down to the very specific—and rare—geological conditions needed for it to form. Lead is typically mined from galena (lead sulfide) ore, and you often find it hanging out with other valuable metals like zinc, silver, and copper.

For these rich deposits to form, a few key things had to happen millions of years ago:

- Ancient Seas: Many of the largest deposits were formed in old sedimentary basins on the ocean floor.

- Volcanic Activity: Think of it like a natural pressure cooker. Hydrothermal activity, powered by underground magma, dissolved minerals and then redeposited them into the concentrated veins we mine today.

This is exactly why places like the Australian Outback and the Andes mountains in Peru are so loaded with these resources. They just happened to have the perfect geological recipe at the right time.

It's crucial to remember that reserve estimates aren't set in stone. They're constantly changing. New discoveries are made, mining technology gets better, and economic tides shift. A deposit that was way too expensive to mine ten years ago might suddenly become a goldmine with new extraction methods.

Tracing the Global Trade of Lead Materials

Once lead is pulled from the ground, its journey shifts from a geological lottery to the fast-paced global marketplace. This is where the distribution of lead becomes a tangled web of mining, refining, and international trade. If you want to understand the modern lead industry, you have to get a handle on how producing nations and industrial consumers are all connected.

This global supply chain is anything but static. Things like mine closures, a sudden spike in demand for car batteries, or new government policies can redraw trade routes almost overnight. It's a dynamic system where the roles of exporter and importer are constantly defining—and redefining—the economic relationships at play.

The Major Exporters of Raw Lead

On one side of this equation, you have the countries that are rich in raw lead concentrate—the stuff that comes straight from the mines. These nations are the foundational suppliers for the entire world.

Countries like the United States and Russia are major players here, shipping huge quantities of this unrefined material to processing plants across the globe. Their ability to consistently mine and ship lead concentrate gives them a strong foothold in the early stages of the supply chain. This is a totally different ballgame from the business world, where a company’s success often hinges on smart lead generation rather than raw materials.

Here's a common misconception: people assume the country with the biggest reserves is automatically the biggest exporter. In reality, export volumes depend more on mining capacity, how much they can process domestically, and international trade deals. The real picture is far more nuanced.

For example, the United States was the top exporter of lead concentrate in 2022, a clear sign of its key role in the global supply chain, with Russia ranking third. On the other side of the coin, China has been the largest buyer for a decade, though its import share has been slipping. Meanwhile, South Korea's imports have shot up, showing just how quickly industrial demand can shift.

The Industrial Powerhouses Driving Demand

On the other side are the major importers. These are the industrial powerhouses that chew through enormous amounts of lead. These nations usually have advanced refining facilities and huge manufacturing sectors that need a steady supply of lead for things like batteries, construction materials, and electronics.

Industrial giants like China and South Korea absolutely dominate here. Their factories are the main destinations for the raw lead concentrate shipped from exporting countries. This sets up a very clear economic relationship:

- Exporters cash in on their natural resources.

- Importers fuel their industrial growth by turning those resources into finished products.

This trade flow really shines a light on the different roles within the global lead market. While some countries provide the raw earth, others bring the industrial muscle. It’s a perfect example of how the international distribution of lead is really a story of specialization and mutual dependence.

The Unequal Health Burden of Lead Exposure

While the story of lead as an economic commodity is global, its human cost is tragically concentrated. The health burden from lead exposure isn’t spread evenly across the planet. Far from it. Instead, it’s a full-blown public health crisis hammering specific regions, exposing a massive imbalance in our global system.

This isn't a random tragedy. This unequal distribution of lead is a direct result of several overlapping problems: rapid and often unregulated industrial growth, the explosion of informal industries like backyard battery recycling, and huge gaps in environmental and public health enforcement.

The outcome? The communities least equipped to handle the toxic fallout are the ones suffering the most.

The Epicenters of the Crisis

The data paints a grim, undeniable picture. South and East Asia are bearing the brunt of this global health emergency, facing staggering numbers of deaths and disabilities that can be traced directly back to lead poisoning.

Just look at the 2019 research, which lays out the disparity with shocking clarity. South Asia saw an estimated 288,270 deaths from lead exposure, while East Asia wasn't far behind with 287,100 deaths.

The five countries with the highest mortality rates tell the whole story: China (282,200), India (232,510), Bangladesh (30,780), Indonesia (27,400), and Pakistan (21,170).

This chart drives home just how devastatingly concentrated the problem is.

A handful of nations shoulder the vast majority of lead-related deaths. It’s a powerful visual that underscores just how localized this public health catastrophe has become.

Why This Disparity Exists

The reasons behind this tragic concentration are complex, but they're not a mystery. It's often a story of economic ambition outpacing the capacity to regulate it safely.

Here are some of the key contributors:

- Informal E-Waste and Battery Recycling: This is a huge one. Unsafe, small-scale operations that smelt lead from old car batteries are a primary source of exposure in countless communities.

- Industrial Emissions: Factories that lack modern pollution controls are constantly releasing lead into the air, soil, and water, poisoning the local environment.

- Legacy Contamination: The historical use of leaded gasoline and paint has left a toxic residue in urban soils that lingers for decades.

- Lack of Public Health Infrastructure: There's often a severe lack of resources for blood lead screening, public awareness campaigns, and medical care for those affected.

This creates a vicious cycle. The health impacts drain a community's resources, which in turn makes it even harder to build the very regulations and infrastructure needed to stop the exposure in the first place. It’s a challenge that demands a sustained, multi-faceted response.

This is a world away from the challenges businesses face online, where the focus is on efficient processes like automated lead nurturing to manage potential customers. Yet, both scenarios reveal how critical it is to have systems that protect and properly manage valuable assets—whether those assets are business leads or public health.

The Disconnect Between Lead's Origin and Its Consequences

So, we've traced lead's journey from deep within the earth to the global marketplace. It’s a story with a disturbing paradox at its core. On one hand, you have geological luck, which concentrates lead reserves in just a handful of nations.So, we've traced lead's journey from deep within the earth to the global marketplace. It’s a story with a disturbing paradox at its core. On one hand, you have geological luck, which concentrates lead reserves in just a handful of nations. On the other, economic power carves out specific trade routes, and the health fallout lands squarely on developing regions.

It's time to connect these dots.

The way lead moves around the world isn't a simple supply chain. It's a system where the economic upside and the health disasters are separated by thousands of miles and wildly different regulations. This isn't an accident. It's the direct result of powerful economic drivers and huge gaps in global oversight that basically allow risk to be outsourced.

The Economic Engine and Its Blind Spots

How does a country with almost no natural lead reserves become one of its biggest users? The answer is simple: industrialization and global trade. Nations with massive manufacturing sectors, especially for cars and technology, create an insatiable demand for refined lead, mostly for batteries.

They import raw or partially processed lead, turn it into expensive goods, and pocket the profits. This creates a powerful economic engine that fuels demand but conveniently insulates the end-consumer nations from the brutal environmental and health costs of production. The dirtiest work—the mining, the smelting, the dangerous informal recycling—gets pushed to countries with cheaper labor and looser environmental rules.

What you end up with is a system where the profits are privatized by corporations and wealthy nations, while the costs are socialized onto vulnerable communities somewhere else. It's a global arbitrage of risk, plain and simple.

The Regulatory Gaps That Let This Crisis Happen

So why don't the industrial nations driving this demand face the same public health nightmares we see in places like South Asia? It comes down to a one-two punch: tough laws at home and weak oversight internationally.

Wealthy nations have, for the most part, gotten rid of the most common sources of lead exposure. They banned leaded gasoline ages ago, put strict limits on industrial pollution, and have solid public health systems to track and treat lead poisoning. The problem isn’t that we don't know how to fix this; it's that the solutions aren't applied everywhere.

This has created a massive global divide:

- In High-Income Countries: Strong environmental laws, workplace safety standards, and consumer protections have made large-scale lead poisoning a thing of the past.

- In Low- and Middle-Income Countries: Rules are often weak, underfunded, or just not enforced. This leaves entire communities exposed to incredibly hazardous industrial practices.

This gap allows the global economic machine to protect citizens in one part of the world while poisoning them in another. Fixing this isn't just about tweaking supply chains; it’s about building transparent, efficient systems. For a business, using effective lead distribution software is a micro-example of how streamlined processes stop valuable assets from getting lost. On a global scale, closing these regulatory gaps is the only way to ensure human health isn’t the price we pay for progress.

The current distribution of lead shines a harsh light on a deep ethical and economic imbalance. It’s a problem that demands a much more holistic and globally responsible solution.

Common Questions About Lead Distribution

We've unpacked a lot about how lead gets distributed, but it's natural to still have a few lingering questions. It’s a complex topic, touching on everything from geology to global economics and public health.

Let's tackle some of the most common queries that pop up.

Why Is Lead So Heavily Concentrated in Just a Few Countries?

It's a fair question. It might seem odd that a handful of countries are sitting on most of the world's lead, but the answer goes back millions of years. It all comes down to geology.

Lead doesn't just form anywhere. It requires very specific, ancient geological conditions—think volcanic and hydrothermal activity churning away on old seabeds. This geological lottery meant that places like Australia and China, which happened to have the right environment at the right time, ended up with massive, commercially viable lead deposits. It has less to do with modern borders and much more to do with where these mineral-rich veins formed long ago.

What’s the Biggest Driver of the Global Lead Trade?

Hands down, the single biggest driver is the battery industry. Specifically, we’re talking about lead-acid batteries, which are the lifeblood of vehicles all over the world. They account for the vast majority of all lead used today, and as the number of cars on the road keeps climbing, so does the demand for lead.

While you'll find lead in other things—like pigments, ammunition, or radiation shielding—nothing comes close to the sheer volume consumed by battery manufacturing. As more countries industrialize and their citizens buy more cars, the demand just keeps growing, fueling the complex global trade routes we see today.

Here's a critical point that often gets missed: the trade isn't just for new batteries. Recycling used lead-acid batteries is a huge secondary market. The problem is, a massive chunk of this recycling happens in informal, unregulated setups, which is a direct cause of the environmental contamination and public health crises we’ve discussed.

Why Do Developing Nations Suffer the Worst Health Impacts?

This is probably the most important question of all. It's a tragic reality, but the health burden of lead exposure falls squarely on the shoulders of low- and middle-income countries. This comes down to a stark difference in regulations and industrial practices.

There are a few key reasons for this imbalance:

- Lax Environmental Laws: Many developing nations simply don't have the tough environmental and workplace safety laws that are standard in wealthier countries. This opens the door for unsafe mining, smelting, and recycling.

- The "Backyard" Economy: A huge amount of lead recycling takes place in small-scale, unregulated operations. These informal smelters pump toxic fumes and dust directly into local neighborhoods.

- Lack of Health Infrastructure: These countries often lack the resources to monitor blood lead levels, treat poisoning, or even just educate people about the risks. As a result, the problem spirals out of control.

In essence, developed nations have effectively outsourced the dirtiest, most dangerous parts of the lead lifecycle to places with fewer protections, creating a massive and unjust global health gap.

Ready to stop losing leads and start closing deals? LeadSavvy Pro automates your Facebook lead capture, sending new prospects directly to your team in real-time. Sign up for free and streamline your lead management today!